Budget estimates grounded in specific operational activities tend to be more precise, reducing the likelihood of overestimation or underestimation of costs. This accuracy aids in financial planning and helps avoid unnecessary expenditure or potential financial shortfalls. In conclusion, the use of an activity base is integral to the ABC method of accounting. It enhances the accuracy of cost allocation, thus providing a sound base for key business decisions. Activities involving a batch of products—as opposed to individual items. An example of a batch activity is the setting up of a machine to produce a batch of 1,000 identical items.

batch-level activities

Over the period, we have performed one thousand configurations, which gives us EUR 250 per machine set-up. The ABC approach helps us seggregate costs to fixed, varible and overheads. Whenever products use the same resources in ther production cycle, but use them in a different matter, some weighing is needed.

- The model then attributes these costs to products based on how much the product uses the activity, causing the cost.

- These levels include batch-level activity, unit-level activity, customer-level activity, organization-sustaining activity, and product-level activity.

- Activity Base is an intrinsic part of the Activity-Based Costing (ABC) method.

Comparing Estimates to Actual Costs

When talking about the relationship between activity base and Corporate Social Responsibility (CSR), it may not seem apparent at first sight. However, an informed exploration reveals indirect links, predominantly mediated through cost allocation processes and an organization’s relation with various stakeholders. Furthermore, budgets based on activity bases can adapt to changes in business activities, making for a more flexible and responsive budgeting process. If an organization’s production level increases, the budget can adjust accordingly.

ABCs of Batch Processing

For example, companies will sometimes offer extreme sales, such as on Black Friday, to attract customers in the hope that the customers will purchase other products. This information shows how valuable ABC can be in many situations for providing a more accurate picture than traditional allocation. Figure 9.1 illustrates how the costs in each pool are allocated to each product in a different proportion. The second step is assigning overhead costs to the identified activities. In this step, overhead costs are assigned to each of the activities to become a cost pool. A cost pool is a list of costs incurred when related activities are performed.

Product-Level Activity Base

ABC implementations are a bumpy ride in many companies, often with declining usefulness over time. The best path we can take is to start with a more simple and highly targeted ABC system to mitigate the discussed problems. The Activity-Based Costing originated from George Staubus’s Activity Costing and Input-Output Accounting publication. The method was developed in the 1970s and 1980s in the US manufacturing sector and formalized in its current form by the Consortium for Advanced Management-International (CAM-I).

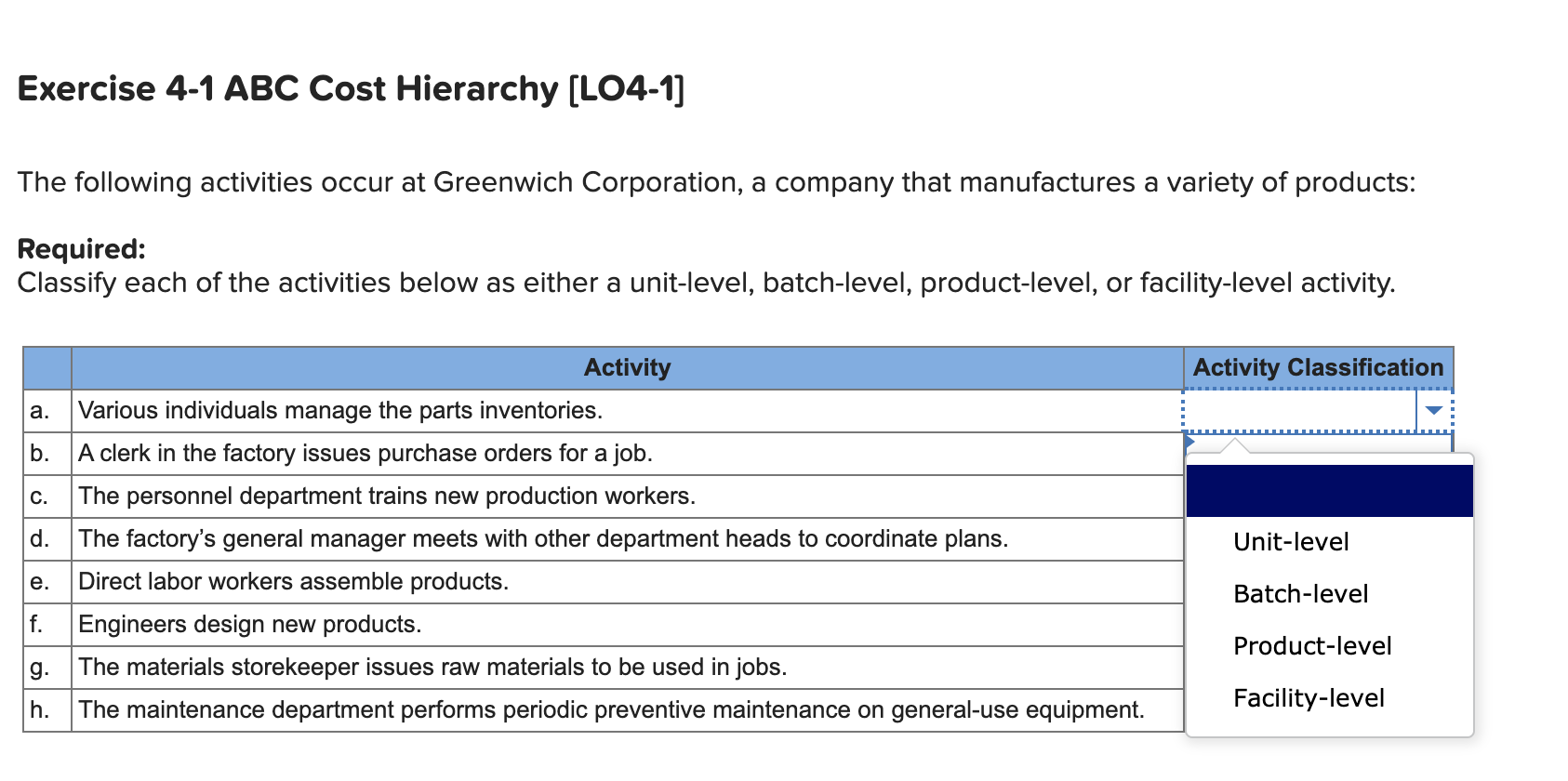

Batch-level activities are work actions that are classified within an activity-based costing accounting system, often used by production companies. Examples of these batch-level cost drivers can often include machine setups, maintenance, purchase orders, and quality tests. Consistent with its more strategic focus, costing system refinement identifies activities in all functions of the value chain. Batch-level activities are one of the five broad levels of activity that activity-based costing account for. Each of these levels is assessed by cost, and these costs are allocated to the company’s overhead costs. In an activity-based costing system, batch-level activity costs are allocated to individual products by dividing the total cost of the batch-level activity by the number of units produced in the batch.

We ask the author(s) to review, fact-check, and correct any generated text. Authors submitting content on Magnimetrics retain their copyright over said content and are responsible for obtaining appropriate licenses for using any copyrighted materials. I am a finance professional with 10+ years of experience in audit, controlling, reporting, financial analysis and modeling. I am excited to delve deep into specifics of various industries, where I can identify the best solutions for clients I work with. Our website services, content, and products are for informational purposes only.

Making this change allows management to obtain more accurate product cost information, which leads to more informed decisions. Activity-based costing (ABC) is the process that assigns overhead to products based on the various activities that drive overhead costs. Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. As such, ABC has predominantly been used to support strategic decisions such as pricing, outsourcing, identification and measurement of process improvement initiatives.

Hence, tactful communication that provides comprehensive context is crucial when conveying such changes. Capturing costs with ABC using activity base information often leads to more transparent pricing. This transparency can prove beneficial for maintaining trust with customers. When consumers understand how costs are apportioned, they are more likely to perceive the prices as fair, building a stronger relationship with the business.

One common difficulty that companies might come across is in selecting an appropriate activity base. This decision should align with the characteristics of a product or service, and the way the business operates. A poor choice could seriously misdirect allocation of overhead costs, leading to a inaccurate understanding of product cost and profitability. batch-level activity base refers to the costs related to a group of units or batch of work rather than individual production units.